|

|

|

You can get e-magazine links on WhatsApp. Click here

|

|

|

|

|

|

Sugar consumption up from 130 million ton in ’01-02 to 178MT in ’13-14

|

|

Saturday, 02 September, 2017, 08 : 00 AM [IST]

|

|

Rinkal Dawra

|

Organisations worldwide have started initiating the investigation upon the effects of sugar consumption on health, owing to which the demand for sugar is expected to decrease.

However, with the growing confectionery industry, the demand for sugar from this industry is expected to continue to increase in the coming years.

According to a study by the World Cancer Research Fund International, sugar is amongst the most widely available and cheapest ingredients. Its consumption has increased from about 130 million ton (MT) in 2001-2002 to 178MT in 2013-2014.

Sugar is a mature market, and the commodity is widely used in different industries such as confectionery and bakery.

The consumption of sugar has shown a constant growth, which is mainly attributable to the growth in population and per capita income.

The daily sugar consumption has also grown high in countries such as the United States, the United Kingdom and Germany.

There is also a disparity in the worldwide consumption or intake of sugar, which varies on the basis of age and setting.

According to the World Health Organisation (WHO), the sugar intake of adults ranges between 7-8 per cent of the total energy intake in countries such as Hungary and Norway and 16-17 per cent in countries such as Spain and the United Kingdom.

The sugar intake is much higher in children, which ranges between 12 per cent in countries such as Denmark, Slovenia, and Sweden and nearly 25% in Portugal.

WHO is currently providing recommendations to reduce intake to less than 10 per cent of the total energy intake, which it has ranked as strong.

Major functional ingredient in confectionery

Sugar is an important ingredient in confectionery. It contributes significantly to the flavour, texture and taste in confectionery products.

Sugar does not only add flavour and taste to the products, but also has other significant properties.

For instance, it is a bulking agent in chocolates and a structuring and hardening agent in candies.

It acts as a foundation to any confectionery product. However, the increasing awareness about the benefits of sugar and calorie reduction would restrain the growth of the sugar market to some extent.

Currently, the usage of alternative sweeteners is a growing trend. Continuous innovations result in confectioners reducing sugar in confectionery, especially during the process of reformulating recipes.

The growth in demand for healthier ingredients and innovative products is also driving the demand for natural sweetening agents.

However, the increased costs of production and distribution are restraining the usage of alternative sweeteners.

Sugar alternatives: Artificial sweeteners dominate the market, while natural sweeteners continue to gain popularity

Currently, there is a growing trend of introducing alternative sweetening ingredients to compete with sugar in the market.

Several ingredient manufacturers have introduced various low-calorie sweeteners and low-fat additives as ingredients in a variety of confectionery products, to satisfy the consumer demand for increased nutrient content.

Individuals who have diabetes need to ensure they keep their blood sugar levels low. Also, the growing health awareness and changing lifestyles drive the demand for confectionery with lower sugar content.

The usage of artificial sweeteners, such as aspartame, cyclamate and saccharin, is a growing trend in the global confectionery industry.

Aspartame is currently one of the most popular artificial sweeteners in the United States food industry.

Apart from artificial sweeteners, the ingredient suppliers also offer sugar substitutes such as xylitol, which is used as a natural sugar substitute to sweeten chocolate, whereas maltitol syrup used as a sugar substitute for confectionery as well as in biscuits and desserts.

Natural sweeteners are one of the fastest-growing categories which form key ingredients in modern confectionery, as a flavour enhancer or improver as a substitute to sugar.

There are a variety of natural sweeteners that are growing in popularity, including ingredients such as fibres, fructose, xylitol and fruit extracts.

Artificial sweeteners: Facing competition from natural sugar

The reduction of sugar content in confectionery is difficult, and replacing it with a sweetener is expensive in terms of production and distribution.

Some producers also believe that sugar-free products are incapable of competing against their own sugar-based products in their portfolio.

Replacing sugar with sweeteners could change the profile of confectioneries, which is not acceptable by most of the potential consumers, as they do not want to compromise on taste and preference.

Sugar-free products are constantly a secondary choice for most consumers; however, surveys, studies, and future regulations with regard to sugar reduction would result in manufacturers replacing sugar with artificial sweeteners so as to reduce the calorie intake.

Manufacturers’ response to the sugar battle for confectionery: A fight-or-flight response!

Confectionery manufacturers are showing a mixed response to the growing health awareness and regulations on the reduction of sugar content in confectionery.

For instance, the Switzerland-based Nestlé S A, one of the leading confectionery manufacturers, is responding to the trend by reducing the sugar content in its products, understanding the health-consciousness associated with it, with the intent of catering to this customer base as well.

For instance, in 2015, it reduced the size of Aero chocolate bar multi-packs by 34 per cent.

However, Nestlé is not focusing on complete reformulation on the basis of sugar content until a more concrete link between sugar health concerns is established.

It is also investing in research and development (R&D) to develop newer technologies, so as to reduce the sugar content in its leading confectionery brands.

Currently, the company is working on a research study which focuses on structuring sugar in a way that it results in identical sweetness to its chocolates, even though lower sugar content is used.

Nestlé scientists believe that it can reduce the total sugar content by 40 per cent in their confectionery brands.

Other participants in the supply chain, after understanding the consumer demand, have also reformulated their confectionery ingredient products and have introduced innovative products.

For instance, Tate & Lyle plc (of the United Kingdom) introduced Tasteva stevia sweetener, which is used as an ingredient in confectionery products.

It is a zero-calorie sweetener from a natural source that allows 50 per cent or greater sugar reduction levels in foods and beverages without the bitter aftertaste.

Also, Cargill (of the United States) offers sweeteners, chocolates, texturisers, emulsifiers, whole grains, fibres, oils, proteins and salt as confectionery ingredients, leveraging on specific nutritional demands, such as reduced sugar, reduced sodium, zero trans-fats per serving and increased fibre.

Global effects of changing import duty on sugar

Countries such as India are experiencing a downward revision of sugar production goals by the millers this year.

According to the Indian Sugar Mills’ Association (ISMA), the estimated production of sugar in India was around 23.4MT in 2016-17, which was less than last year’s output of 25.2MT.

India is one of the largest consumers of sugar worldwide, and often imports the commodity when the domestic output falls.

The lower production of sugar implies that its prices will shoot up in the future owing to an imbalance between the demand and supply markets.

Hence, a majority of industrial buyers such as confectionery and bakery manufacturers are expected to buy the commodity in bulk in the coming months.

This trend is expected to increase the need of importing sugar from other nations.

Recently, the Indian government was planning to cut down the import duty on sugar, and bring it to zero to balance the domestic prices.

However, a revised exercise on the calculation of the production and consumption pattern of sugar is being carried out to recheck the forecasts.

A direct impact of decreasing the import duty on sugar will result in the successive growth of the domestic confectionery industry.

Higher imports will result in a steady demand and lower commodity prices, which will consequently deflate the inflating sugar and confectionery prices in India.

The declining sugar prices are expected to benefit domestic producers in terms of low production costs, resulting in low-priced confectionery products.

The impact of import duty in countries, such as India, will, however, have a mixed impact, as it is amongst one of the top sugar-producing countries owing to a larger production.

Countries with lower production and high imports will have a negative impact on confectionery production and sales.

Sugar confectionery on the rise

One of the most promising and significant markets of the confectionery industry is sugar confectionery.

Confectionery includes a wide range of food items ranging from boiled sweets, fatty emulsions (toffees and caramels) and fully crystalline products (fondants), to gums, pastilles and jellies.

Attributes such as texture, flavour, colour, the quantity of sugar and volume of ingredients affect the consumers’ decision making while purchasing sugar confectionery products.

There are also various factors affecting the production and storage of sweets that the manufacturers take into consideration, such as the time and temperature of boiling, the residual moisture content and the addition of other ingredients.

The inclusion of properly formulated natural sugar subsequently leads to the increasing demand for sugar globally.

Despite voluntary sugar targets and calorie limits in countries such as the United Kingdom, the demand for sugar and sugar confectionery continues to rise.

Confectionery products are purchased for different objectives and purposes. For instance, chewing gums and mints are used as a mouth freshener, and pastries and fudge among others are considered as indulgence products.

Therefore, a constant growth is expected from the confectionery industry in the long run, especially for formats such as medicated confectionery or mints.

On the regional demand side, the Asia-Pacific region is one of the most promising markets.

With the rising population and the improving purchasing power of consumers in developing countries, such as China, India, Singapore, Malaysia, Indonesia, Thailand and Vietnam, the market in this region is expected to witness significant growth in the future.

In the emerging Asian economies, such as India, the penetration of the market for sugar confectionery is high, due to factors such as growing awareness, rising urbanisation and a large number of variants, leading to higher demand in the region.

Some of the fastest-growing categories are gums, jellies, chews and pastilles.

Expanding local brands, the rising number of new entrants and the launch of a large variety of products in the Asia-Pacific region is expected to promise a wider growth for sugar confectionery, subsequently driving the demand for sugar on a larger scale.

On the other hand, mature markets of sugar confectionery, such as the United States, are experiencing a decline in demand for confectionery owing to increased public awareness about health and nutrition.

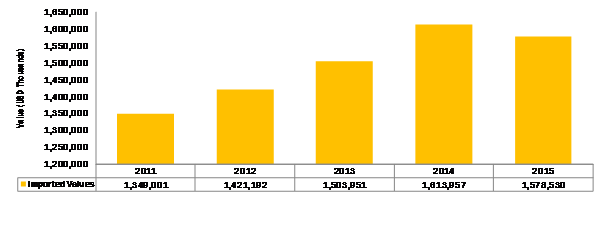

According to the International Trade Centre (ITC), the imported value of confectionery to the United States in 2014 was $1,613,957 thousand, declining by 2.2 per cent with a value of $1,578,530 thousand in 2015.

Figure: Imported value of sugar confectionery in the United States, 2011-2015 ($ thousand)

[Sources referred: World Cancer Research Fund International, National Confectioners Association, American Hellenic Chamber of Commerce, MarketsandMarkets Analysis, Department of Commerce, World Health Organisation (WHO) and International Trade Centre (ITC).]

(The author is research analyst, MarketsandMarkets. She can be contacted at rinkal.dawra@marketsandmarkets.com.)

|

|

|

|

|

|

|

|

|

|