With the growing agrochemical industry in Asia-Pacific, players are investing more in the region. India's regional market acts as a growth driver in the agrochemical market of Asia-Pacific region.

For instance, in March 2022, AgFarm, a Dubai-based agrochemical startup that intends to digitally revolutionise the agricultural sector by allowing purchasers to access and buy agro-inputs with only a few clicks. The newly launched company has built offices in India as well, following their objective of producing and selling high-quality agro-based products to Indian consumers.

Post-Covid-19, agrochemical manufacturers, and suppliers are turning to e-commerce platforms like nurture.retail, DeHaat, AgroStar, FAARMS, and others to market agrochemical products such as herbicides, insecticides, fungicides, and plant growth regulators. These platforms will open up digital connections between manufacturers, merchants, and dealers, allowing them to purchase products at low rates with the highest level of quality assurance.

In addition, players are choosing for merger and acquisition strategies to gain a significant market share in the industry. For instance, in March 2022, Hextar Global Bhd proposed to acquire 109,900 shares in Indonesia-based agrochemical company PT Agro Sentosa Raya (PTASR), for RM10.2 million. Hextar Global's position in the regional agrochemical sector is projected to be strengthened as a result of the proposed acquisition.

The global market for agrochemicals is expected to increase from US$214.7 billion in 2021 to $259.8 billion by 2028, with a CAGR of 3.0% over the forecast period (2022-2028). In recent decades, agricultural markets have expanded as a result of increased food demand induced by the rapid growth of the human population. High population and the resulting growth in food consumption, soil degradation, limited agricultural land, and increased consumer awareness of the benefits of agrochemicals are the primary factors driving the global agrochemicals industry.

However, the potential threat of synthetic pesticides like 2, 4-D, and atrazine herbicides could impede market expansion. When agrochemicals are used in larger concentrations, they pollute surface water and harm the environment. As a result, the production of bio-based fertilisers and pesticides has opened up a whole range of opportunities for key industry participants.

Figure 1: Global Agrochemical Market, By Value (US$ Million) 2018-2028

Source: ICAMA, Secondary Search, and BlueWeave Consulting Analysis

Agrochemicals are made up of chemical compounds that go through a series of activities that release poisonous gases and fumes that can affect the environment. Agrochemicals are beneficial to crops, yet they can be hazardous to humans and animals.

As a result, regulatory agencies such as the Registration, Evaluation, Authorization, and Restriction of Chemicals (REACH), and the Environmental Protection Agency (EPA), handle them by mapping and monitoring toxicity emissions within acceptable limits. As a result, the major restricting factors for the market are various authorities' regulations on the use of agrochemicals in various countries.

Agrochemical Raw Materials Insights

Any chemical used in agriculture, such as chemical fertilisers, herbicides, and insecticides, is referred to as an agrochemical. The majority are combinations of two or more compounds, with active ingredients providing the desired effects and inert substances stabilising or preserving the active ingredients or assisting in the application.

The agrochemicals industry uses many crude oil-related raw materials like chlorine, yellow phosphorus, and bromine, among other substances. These are essential raw materials for the production of agrochemicals; even in little doses, these raw components are highly potent and produce the best outcomes.

Nonetheless, unpredictable crude oil prices have an impact on agrochemical manufacturing production and pricing. The top three agrochemical manufacturers in the world are the United States, Japan, and China, with China producing 90% of the world's agrochemical raw materials.

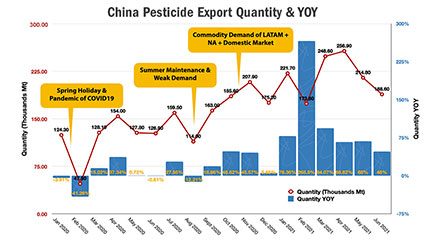

According to the most recent agrochemical report (June 2021), by ICAMA (The Institute for the Control of Agrochemicals of the Ministry of Agriculture), for cyclical exporting patterns for China. In summer, Chinese manufacturers need maintenance. After the strong demand from North America and Asia-Pacific, the exporting volume will be lower from July to August than in previous months due to facility maintenance.

Figure 2: China Pesticides Export Quantity & YOY, 2020-2021

Source: ICAMA, Secondary Search, and BlueWeave Consulting Analysis

Regulations in raw materials supply and production, higher shipping costs and weather events etc. are the major factors leading to rising prices of agrochemicals in the industry. The graph below showcases rising prices of herbicides and fungicides for 2019-2021.

Figure 3: Price Variation of Glyphosate Herbicides, 2019-2021

Source: China Price Index, Secondary Search, and BlueWeave Consulting Analysis

Figure 4: Price Variation of Clethodim Herbicides, 2019-2021

Source: China Price Index, Secondary Search, and BlueWeave Consulting Analysis

Figure 5: Price Variation of Tebuconazole Fungicide, 2019-2021

Source: China Price Index, Secondary Search, and BlueWeave Consulting Analysis

Figure 6: Price Variation of Trifloxystrobin Fungicide, 2019-2021

Source: China Price Index, Secondary Search, and BlueWeave Consulting Analysis

The industry is fragmented into fertilisers and plant growth regulators based on agrochemical products. Amidst the segmentation, the fertiliser segment dominated the market in 2021, accounting for 65% of global revenue.

Fertilisers are commonly utilised to boost crop output in a short amount of time. Growing crop/food demand around the world is putting additional strain on agricultural land; hence farmers are using more fertilisers to boost the productivity and yield of various crops.

The fertiliser market is further subdivided into nitrogenous, phosphatic, potassic, and secondary fertilisers, among other categories. Over the projected period, the nitrogenous fertiliser segment is expected to grow at the fastest rate.

Cereals and grains, oilseeds and pulses, fruits and vegetables, and other crops are among the most common uses of agrochemicals (fertilisers and plant growth regulators). Cereals and grains are the most widely consumed crops, particularly in the Asia Pacific.

Furthermore, cereals and grains are produced on a large scale worldwide. In the production of cereals and grains, the use of agrochemicals has nearly become mandatory. The demand for agrochemicals in the industry is being driven by the rising consumption of cereals and grains such as rice, sorghum, wheat, rye, corn, oats, and barley in various other regions. Rice, wheat, and other cereals and grains are the crops that require the most agrochemicals.

Furthermore, soil nutrient deficit can lead to less accessible nutrients in crops like wheat and rice, resulting in lower yields. Over the projected period, the fruits and vegetable segment is expected to increase at the fastest CAGR. This increase might be attributed to the rising demand for fresh fruits and vegetables around the world as people become more health-conscious.

In 2021, Asia Pacific was the dominant regional market, with the largest market share; it is the world's leading producer of agricultural products. India, China, and Japan are major contributors to the regional market. According to the ITC (International Trade Center), and the Food and Agriculture Organisation (FAO), China is the world's largest exporter and manufacturer of pesticides. After China, Japan, and the United States, India is the world's fourth-largest producer of agrochemicals, as per the OECD (Organisation for Economic Co-operation and Development) and the Food and Agriculture Organization (FAO).

The region's per capita income is majorly dependent on the agricultural sector. Some crops, such as maize, sorghum, blueberries, and almonds, are produced in large quantities in the United States. According to the FAO, the United States is a major producer, consumer, and exporter of agrochemicals.

Better grain commodity prices, favourable weather patterns, and easing trade tensions with China are among the major reasons propelling the market in the country. Severe drought in the western United States has also boosted demand for miticides.

Impact of Covid-19 Across the IndustryThe global agrochemical supply chain was impacted in 2020 as a result of the pandemic's containment measures. Changes in the crop protection industry have developed new obstacles for global sourcing.

Recent M&A activity, as well as the phasing out of numerous businesses as a result of environmental legislation, has posed a challenge to the agrochemical industry's supply and structure. Only a few manufacturers have a chance to dominate market share due to resource integration of raw materials and key intermediates from the upstream. The integration of capacity will strengthen the power of suppliers.

Pest attacks, crop yields, and agriculturists' awareness and capability to acquire products based on credit availability all influence market expansion. Increased demand for pesticides around the world is also propelling the industry forward. The Covid-19 pandemic has impacted agrochemical production to some extent, and some countries were reliant on China for raw materials prior to the pandemic.

Innovation is always a hot topic in China's agrochemical sector, aside from off-patent active ingredient R&D and production cost savings. In an effort to eliminate herbicide-resistant weeds in crops around the world, KingAgroot in Qingdao is focussing on giving the most comprehensive solutions — from new compounds to gene-editing breeding.

Transportation and import restrictions enforced across borders in many countries have resulted in a lack of raw commodities. Export volumes in March and April 2021 were higher than in March and April 2020, owing to global supply chain disruptions caused by the Covid-19 pandemic, which disrupted the worldwide purchasing cycle. Since then, global distributors have had to plan ahead for lead-time.

When farmers become "cautious investors" in the post-pandemic era, multinational companies and domestic agrochemical distributors will face increased rivalry. Some newcomers to the global market, such as Farmers Business Network in the United States, are attempting to make agriculture more transparent. When FBN offers a new independent breeder base on a farmer-to-farmer (F2F), business model, it will provide a fresh challenge to multinational businesses' traditional "seed and agrochemical" initiatives. F2F models may develop in more countries as economies falter.

(The author is research director at Blue Wave Consulting)