|

|

|

You can get e-magazine links on WhatsApp. Click here

|

|

|

|

|

|

Global potato starch market trends

|

|

Wednesday, 15 May, 2024, 15 : 00 PM [IST]

|

|

Mathivanan Govindhan

|

Starch is a major building block of modern industry, and its production and use have long been correlated with strong economic growth. Starch is the primary source of stored energy in cereals and tubers, and it is estimated that 70-80% of the carbohydrate-based calories consumed by humans across the world are provided through a starch-based product. Starch is commercially produced from various sources such as corn, tapioca, wheat, potato, rice, pea, barley, sago, and sweet potato.

There are two types of potatoes used for industrial starch processing. Starch potatoes, with a starch content above 18%, are mainly grown for starch processing in Europe. Regular potatoes, which have a 12% and 15% starch content, are used for starch processing outside of Europe.

In the potato starch industry, there are three types of producers. The first type buys regular potatoes or starch potatoes to extract starch. The second type primarily uses side-stream products from potato processors to make potato-based starches. Finally, the third type (secondary converters) purchases starch from producers and modifies it to supply specific food and non-food sectors.

The potato starch market has undergone major changes during the last decade. Potato starches are increasingly used as clean-label ingredients in many food categories, and advances in technical development are expanding their use in non-food applications.

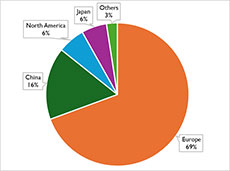

Global production of potato starch and derivatives by countries/regions, 2450kt, 2023

Global potato starch and derivatives production was estimated at 2450 kt in 2023. Native potato starch dominates the production, followed by modified starch, maltodextrin, and dextrose. Global potato starch and derivatives production was estimated at 2450 kt in 2023. Native potato starch dominates the production, followed by modified starch, maltodextrin, and dextrose.

Europe is the largest producer of potato starch and derivatives globally. There are several reasons for this. Europe is the largest producer and consumer of potato starch and derivatives. Europe is known for producing the highest-quality seed potatoes in the world. Typically, starch potatoes have a starch recovery rate of 18-20%. The usage of advanced technology for potato storage and starch and derivatives production.

Potato starch production in the European Union was regulated by a quota system until 2012. The quota allowed to produce up to 1.95 mio tons of starch per year, with subsidies of EUR 66.32 per ton of starch and a range of subsidies from EUR 500 to EUR 600 per hectare of starch potato production. However, in 2003, the EU decided to remove the quota system, which resulted in the removal of subsidies. This caused an increase in the price of potato starch, making it less competitive than other cereal starches. As a result, the industry underwent significant changes, shifting its focus to the food sector as the current prices did not favour the use of potato starch in non-food sectors due to cost issues.

The potato industry has faced various challenges apart from the Covid-19 pandemic in the last three years. Due to the conflict between Ukraine and Russia, high energy costs for starch processing have been a major issue. Additionally, environmental conditions have led to the cost of starch potatoes. The potato starch industry has also faced tough competition from the French-fries industry, which has seen increased demand from local and export markets. Some potato starch producers have reported that farmers are selling potatoes to the French fries industries. This has affected the availability of potatoes for starch processing. Potato starch production has declined heavily in regions such as Germany and France, with production dropping from 621kt in 2021 to 450kt in 2023. Tereos, a potato starch producer in France, has even stopped its potato starch production facility. However, countries like Denmark have not been affected, and their production has steadily increased over the last four years.

China is the world's second-largest producer and consumer of potato starch, after Europe. However, in the last two years, potato starch production in China has declined by over 30%. There are two main factors behind this decrease in production. Firstly, the government has been offering incentives and price support for soybean cultivation, reducing potato planting areas. Secondly, the quality of potatoes has been affected by changes in the weather. In 2007, China imposed an anti-dumping duty on potato starch imports from other countries to protect its domestic potato starch industry. This restriction has been extended three times since then, in 2013, 2018, and most recently in September 2023. As a result, the entry of European potato starches into the Chinese market is limited.

Over the past decade, the production of potato starch and its derivatives has fluctuated between 160-200kt. Unfortunately, in 2023, there was a poor harvest of starch potatoes in Japan, leading to the lowest production of potato starch and derivatives ever recorded. To meet the domestic demand, Japan had to import potato starch from the EU.

Potato starch producers in the USA and Canada mainly use side-stream products from potato processors as their primary raw material for making potato-based starches used in various food and industrial applications. Production has steadily increased in recent years thanks to the growing supply of side-stream products from potato processors in the French-fries industry.

In the beginning, it was uncertain if European potato producers would be able to prosper without government subsidy support. However, they proved to be resilient and capable of achieving success on their own. Currently, the potato starch industry in Europe appears to be strongly positioned to dominate in the near future due to its advanced processing technology, superior products, raw materials, and marketing strategies. This makes it difficult for other countries, such as China, the USA, and Japan, to catch up with Europe in the potato starch industry across all these parameters. It will be interesting to observe future developments from India, particularly their government's involvement in supporting the potato starch industry.

(The author is a project manager at Giract)

|

|

|

|

|

|

|

|

|

|