|

|

|

You can get e-magazine links on WhatsApp. Click here

|

|

|

|

|

|

The sweetening chocolate market in India

|

|

Tuesday, 11 June, 2024, 08 : 00 AM [IST]

|

|

Charudatt Gangurde

|

Introduction:

The chocolate market in India has witnessed considerable expansion over the past few years, which can be attributed to a shift in consumer choices (toward healthier choices), rising disposable incomes, and increasing awareness of global trends. As opposed to the previous trend of consuming chocolates only on special occasions, the rising disposable income, specifically in urban areas, has led to an increase in the consumption of chocolates on a more regular basis. Moreover, India has a significant young population (<25 years of age), which is a major consumer of chocolates. This young demographic is a significant force driving the market growth. In addition, the health advantages and antioxidant properties of dark chocolate are leading to an increase in its consumption and popularity.

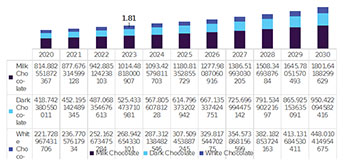

The India chocolate market size was estimated at US$1.82 billion in 2023 and is projected to grow at a CAGR of 8.6% from 2024 to 2030. The Indian chocolate market is diverse in nature and segmented by product types, each catering to different consumer preferences. The traditional chocolate market in India can be categorised based on the following product types: milk chocolate, dark chocolate, and white chocolate. The milk chocolate product segment has been the dominating one in the Indian market, with nearly 56% revenue share of the total product revenue.

India Traditional Chocolate Market, By Product, 2020-2030 (US$ Billion) India Traditional Chocolate Market, By Product, 2020-2030 (US$ Billion)

The dark chocolate category is anticipated to witness the fastest CAGR of 9% in the coming years. This growth is due to the health benefits associated with dark chocolate, and it contains antioxidants and minerals like iron and magnesium. It can improve heart health by reducing blood pressure and improving blood flow and may also boost brain function and insulin sensitivity. Dark chocolate has been linked to stress relief and mood improvement, which can be beneficial for overall mental health. However, these benefits are most likely to be seen in scenarios of moderate consumption of dark chocolate and as part of an overall balanced diet and healthy lifestyle.

Competitive Summary

The Indian chocolate market is characterised by heavy competition among key players, with each player adopting various strategies to expand their market share. The majority of Indian consumers are particularly price-sensitive; therefore, brands are always trying to find the right balance between quality and affordability. Most companies are increasingly using social media campaigns, digital marketing, and influencer partnerships to connect with younger consumers. Marketing with emotional aspects and focusing on the indulgence and luxury aspects of chocolate is also being done. In addition, the strategies adopted by these players include product innovation, strategic marketing, and extensive distribution to maintain and increase their market share. The leading brands in the Indian market include Mondelez India (Cadbury, Toblerone and so on), Mars, Ferrero Rocher, Hershey’s, Nestle, and Amul.

Mondelez India (Cadbury) is the dominant player in the Indian chocolate market and has maintained its dominant position by building strong brand equity through consistent advertising and innovative campaigns having ground-level emotional connect with Indian consumers. Mondelez has a diverse product range, including Dairy Milk, 5 Star, Silk, Perk.

Nestle India, with its wide range of products such as Kit Kat, Munch, and Alpino brands, has been able to maintain its position as a strong competitor. Nestle continues to innovate by introducing variants to existing brands catering to the changing tastes of Indian consumers. With its well-established distributor network, Nestle has maintained its market share in both urban and rural markets.

Ferrero Rocher, Hershey’s, Mars, Lindt, Godiva, and Ghirardelli are the luxury premium brands of chocolates in India. Ferrero Rocher, with its product portfolio including Ferrero Rocher, Kinder Joy, and Tic Tac, emphasises on gifting and premium experiences during festive and special occasions, leveraging its international reputation for quality. Mars has a presence in the Indian market with products such as Snickers, Mars, and Galaxy. Mars focuses its marketing strategy on the snacking and nutritional benefits of its products.

Current Market Trends

Rise of local and artisanal chocolate brands:

The India chocolate market is undergoing a noticeable transition towards artisanal and premium chocolates. This can be attributed to the rising disposable incomes and enhanced consumer preferences. There has been a rise in local and artisanal chocolate brands in India in the last few years. Artisanal chocolates are handcrafted and prepared using exotic ingredients. Consumers seeking high-quality, locally sourced, and unique chocolate experiences are developing a taste for artisanal chocolates. Artisanal chocolates include local ingredients that celebrate Indian flavours and traditions. Some of the brands include Naviluna Artisan Chocolates, Paul & Mike's Chocolates, Mason & Co., and Soklet Chocolates.

There has also been notable growth in the premium chocolate segment of the Indian market. Premium chocolates, comprising high cocoa content and superior-quality ingredients, are gaining popularity among health-conscious and luxury-seeking consumers. Indian consumers, while maintaining strong loyalty to established brands, are also showing a rising willingness to experiment with new and niche brands, particularly in the premium segment. Due to the rapid growth of e-commerce and online shopping, these premium brands are easily accessible, which is aiding in their market share.

Festival Season Spikes

The Indian festival season, as per various marketing companies, is from September to December. During the festival season, leading chocolate brands position their products as popular gifting options and try to adopt the Indian tradition of gifting sweets, driving seasonal spikes in demand. Leading companies have successfully captured this trend by niche advertising related to festive seasons and by modifying the packaging and presentation of the products to represent festive fervour.

Ethical Sourcing and Sustainability

The Indian chocolate industry is adopting sustainability principles by concentrating on packaging from low-waste, sourcing from organic farms, and using low-energy machinery. Companies are implementing principles of circular economy to limit the amount of waste products to a minimum and to reintegrate resources into the product cycle. Artisanal chocolate companies in India are concentrating on indigenous ingredients and native flavours while empowering women employees as part of their ethical business model. Ethical sourcing also involves implementing fair trade practices that ensure cocoa farmers receive fair compensation for their labour, better working conditions, and accessible healthcare and education. Indian consumers welcome the emphasis on sustainability and ethical sourcing, and adopting these practices also increases the brand value of the companies.

Some of the developments in this regard:

- Kocoatrait, a Chennai-based chocolate brand, utilises discarded materials of cotton cloth and cocoa shells to use it for reusable plastic-free packaging, which can be recycled.

- In 2021, Mondelez India announced its commitment to sourcing 100% sustainable cocoa for its Cadbury brand in India by 2023. They are working with partners like Cocoa Life to support cocoa farmers and promote sustainable farming practices.

- Soklet Chocolates, a Goan artisanal brand, emphasises sustainability in its operations. It uses locally sourced cocoa beans and ingredients, minimising transportation emissions. Additionally, its packaging is eco-friendly, made from recycled materials, and designed to be fully recyclable or compostable.

In Conclusion

The Indian chocolate market is dynamic and evolving, characterised by shifting consumer preferences and increasing disposable incomes. A thorough understanding of the diverse consumer segments and their specific needs is essential for companies looking to succeed in this constantly growing market.

(The author is team lead, consumer goods research, Grand View Research, Inc. He can be reached at charudatt@grandviewresearch.com)

|

|

|

|

|

|

|

|

|

|