|

|

|

You can get e-magazine links on WhatsApp. Click here

|

|

|

|

|

|

Viksit Bharat 2047 - AIF for cold chains & food processing

|

|

Saturday, 13 December, 2025, 16 : 00 PM [IST]

|

|

Dr Manoj Kumar Mishra

|

The Agriculture Infrastructure Fund (AIF) — a flagship financing facility launched under the Atmanirbhar Bharat package — is a targeted instrument to strengthen India’s post-harvest ecosystem by mobilising medium- to long-term debt for agriculture infrastructure at farm-gate, aggregation points, and processing hubs. By prioritising cold chains and primary/aggregate processing, the AIF seeks to reduce post-harvest losses, improve farm gate price realisation, stimulate private investment, and link producers to higher-value domestic and export markets — all central to the vision of a “Viksit Bharat 2047.”

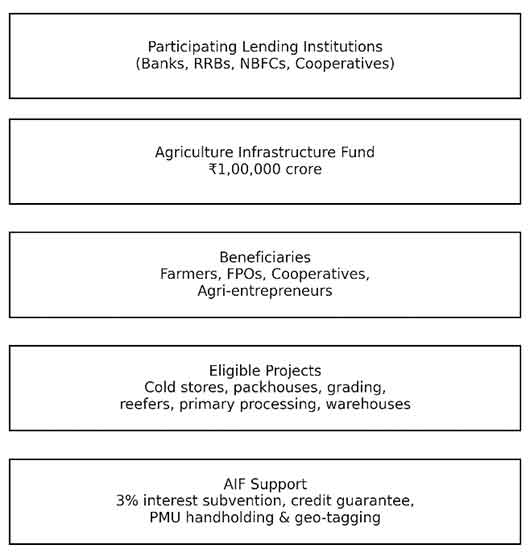

(Fig. 1 – AIF Structure & Financial Flow)

Why cold chains and processing matter for Viksit Bharat 2047

India suffers substantial post-harvest losses — the AIF guidelines estimate national losses at ~15–20% for certain commodities, higher than global best practice of about 5–15%. Losses are concentrated in perishables (fruits, vegetables, dairy, fisheries) where temperature-controlled handling and swift primary processing can dramatically extend shelf life and value. Building robust cold chains and decentralised processing addresses three structural constraints:

1. Loss reduction: Lowering physical waste increases effective supply without additional land or water.

2. Value capture: Cold storage + primary processing permit farmers/FPOs to time sales for better prices, manufacture higher-margin products, and serve processors/retailers.

3. Market access & nutrition: Year-round supply of perishable produce supports urban food security and export readiness. Investment in cold chains supports downstream sectors (food processing, retail, pharma for cold logistics).

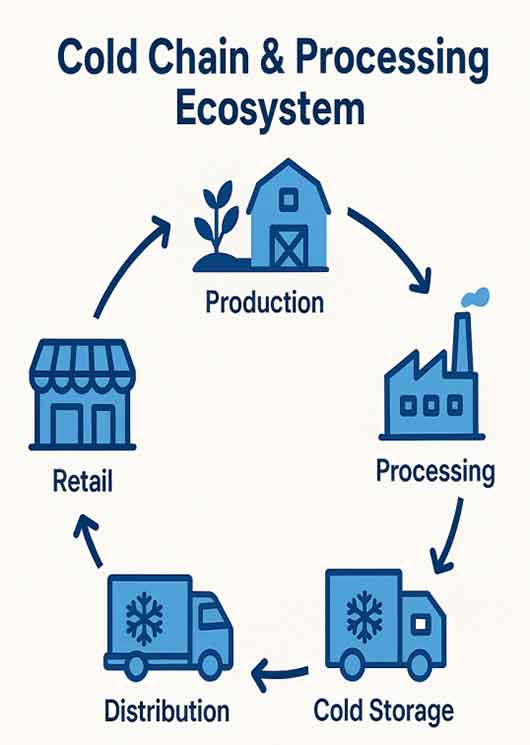

(Fig. 2: Cold chain and processing ecosystem) (Fig. 2: Cold chain and processing ecosystem)

Eligible cold-chain and processing investments under AIF

The scheme explicitly finances a range of post-harvest and cold-chain elements, including but not limited to: cold stores and cold chain systems; pre-cooling, sorting, grading and packaging units; ripening chambers; refrigerated/insulated transport (reefers); primary processing units and integrated processing at farm cluster level; warehouse and silos; and digital/IoT upgrades tied to these assets. Solarisation of eligible infrastructure and digital connectivity are also financed as part of AIF projects. Standalone secondary processing (large standalone food processing plants) is typically not eligible, reflecting a focus on farm-linked, aggregation and primary/secondary integration.

Funding mechanics and incentives (how it catalyses projects)

AIF is a debt-based facility routed via participating lending institutions (commercial banks, cooperative banks, RRBs, NBFCs, NCDC). The key catalytic elements:

- Interest subvention (3%) reduces borrowing cost for small projects, making cold-chain investments bankable for FPOs, cooperatives and micro-entrepreneurs.

- Credit guarantee under CGTMSE lowers risk for lenders for small loans (Rs 2 crore), encouraging them to lend to FPOs and smaller entities.

- Refinance and handholding: NABARD provides need-based refinance and state/district PMUs provide project handholding, cluster identification and geo-tagging for transparency. These reduce transaction costs and implementation risk.

Strategic priorities to align AIF with Viksit Bharat 2047

To translate funding into systemic transformation by 2047, AIF-supported interventions must be designed around five priorities:

- Decentralised, networked cold chains: Invest in many smaller cold rooms, farm-level pack houses and refrigerated transport connected to distribution hubs rather than a handful of mega cold stores; decentralisation reduces transport time and is more accessible to smallholders. (AIF already supports farm-level and hub models in its eligible project list.)

- Aggregation via FPOs & cooperatives: Channel a substantial share of loans (and guarantee coverage) to FPOs, PACS and cooperatives — institutional aggregation increases utilisation rates and spreads fixed costs across members. AIF explicitly includes these beneficiary categories.

- Energy efficiency & renewable integration: Cold chains are energy-intensive. Solarisation of cold stores and adoption of energy-efficient refrigeration and thermal-insulation technologies should be incentivised to contain operating costs and emissions. AIF allows solarisation as eligible.

- Primary processing to add value at source: Financing for primary processing (cleaning, sorting, minimal processing, packaging) turns perishables into longer-lived products (frozen, IQF, minimally processed ready-to-cook) that command better prices and open market and export opportunities. AIF funds many primary processing activities by crop.

- Data and cold-chain logistics platforms: Digital linkages (real-time temperature monitoring, asset geo-tagging, marketplace integration) increase traceability, reduce spoilage, and improve creditworthiness for operators. AIF permits digital connectivity investments as part of projects.

Measurable impact (what success looks like)

Quantitative targets aligned to Viksit Bharat 2047 could include:

- Reduction in post-harvest loss for targeted perishable categories from ~20% ? <10% within a decade in targeted clusters (measured by weight and value saved).

- Increased farmer incomes via higher price realisation and value-addition (target 20–40% improvement in farm-gate returns for producers integrated into AIF-supported value chains).

- Utilisation & deployment metrics: Number of FPOs/cooperatives with AIF loans; megawatt-equivalent solarised cold store capacity; refrigerated fleet kilometres added: and volumes (tonnes) processed and cold-stored annually. AIF bulletin and monitoring dashboards already track sanctioned/disbursed amounts and asset geo-tagging.

Implementation challenges & mitigation

- Operating costs and viability: Cold chains need high utilisation to be commercially viable. Mitigation: cluster-level planning to assure steady throughput (e.g., crop calendars, aggregation contracts), and concessional subvention for initial years.

- Access to technical skills: Small operators require technical training in cold-chain operations and maintenance. Mitigation: State PMUs and NABARD-led handholding, plus convergence with skill programmes.

- Financing last-mile operators: Even with interest subvention, last-mile players may face collateral constraints. Mitigation: use of credit guarantee, group lending, and outcome-based grants/seed equity where viable.

- Energy & environment: Grid reliability and carbon footprint are concerns. Mitigation: prioritise solarisation, energy-efficient cold technology and co-funding from clean energy programmes.

Policy & financing recommendations (roadmap to 2047)

- Scale blended finance: Combine AIF debt with viability gap funding (VGF) or concessional equity for strategic cold-chain nodes in underserved regions.

- Prioritise perishables & export clusters: Use AIF state allocations to fast-track cold chains for high-value and exportable commodities (horticulture, dairy, fisheries).

- Mandate geo-tagging & performance KPIs: Strengthen OOMF (Output & Outcome Monitoring Framework) indicators and publish state-wise dashboards to monitor utilisation, loss reduction, and farmer incomes. AIF already requires geo-tagging — scale transparency further.

- Encourage PPP and aggregators: Use public procurement and PPP models for distribution hubs while supporting private aggregator contracts with FPOs to guarantee throughput.

The Agriculture Infrastructure Fund provides a pragmatic financing architecture that, if strategically deployed, can be the backbone for India’s food systems transformation towards Viksit Bharat 2047. By prioritising decentralised cold chains, energy-smart investments, FPO-led aggregation, and integrated primary processing, the AIF can reduce waste, boost incomes, catalyse private capital, and make Indian agriculture more resilient and competitive. The fund’s initial uptake (tens of thousands of crores sanctioned and disbursed) demonstrates momentum; success through 2047 will depend on targeted design, effective handholding, monitoring, and convergence with energy and skill programmes.

(The author is director & principal, Amity Institute of Pharmacy,

Amity University Madhya Pradesh, Gwalior)

|

|

|

|

|

|

|

|

|

|