|

|

|

You can get e-magazine links on WhatsApp. Click here

|

|

|

|

|

|

Nutraceuticals: Big to biggest

|

|

Tuesday, 19 February, 2013, 08 : 00 AM [IST]

|

|

Hasan Mulani, Mumbai

|

|

fiogf49gjkf0d

With growing concern towards increase in lifestyle-based diseases and focus on health & wellness, the theme of prevention is better than cure is likely to prevail as the most important.

Not only that, it is also going to be the base for increased consumer expectation and demand for nutraceuticals, food for specific dietary uses and functional foods & beverages for their ability to address several diseases.

Growing healthcare and consumer awareness in India and the world has led to variety of terms appearing in the industry. Medi foods, vitafoods, functional foods, nutraceuticals, dietary supplements, and fortified foods to name a few. Of these variants – nutraceuticals is one of the fastest and speedily developing segments in the health food & beverage sector.

Definition

Experts define nutraceuticals as “non-specific biological therapies used to promote wellness, prevent malignant processes and control symptoms they can be broadly categorised based upon the products as vitamins, antioxidants, minerals, herbals / botanicals, non-herbals, proteins and fibres.”

In other words, nutraceuticals products provide health & medicinal benefits which includes prevention and treatment of diseases in addition to the basic nutritional value found in foodstuff. Nutraceuticals are particularly of interest to the present generation because they have the potential to substantially reduce the expensive, high-tech, disease treatment approaches presently being employed in Western healthcare.

The nutraceuticals industry is both a brainchild and product of the need for preventative personalised medicine. Born of consumer demand for better food, the industry continues to use consumers for inspiration. The nutraceuticals sector has moved from healthy diet additions to mandatory diet requirements specifically designed to consumer requirements.

S Siddiqui, senior F&B analyst, said, “Nutraceuticals have gained tremendous importance in the last few years in developing & developed nations. Mostly, the nutraceuticals products are high priced which offer additional profitable benefits to players when compared to traditional foods.”

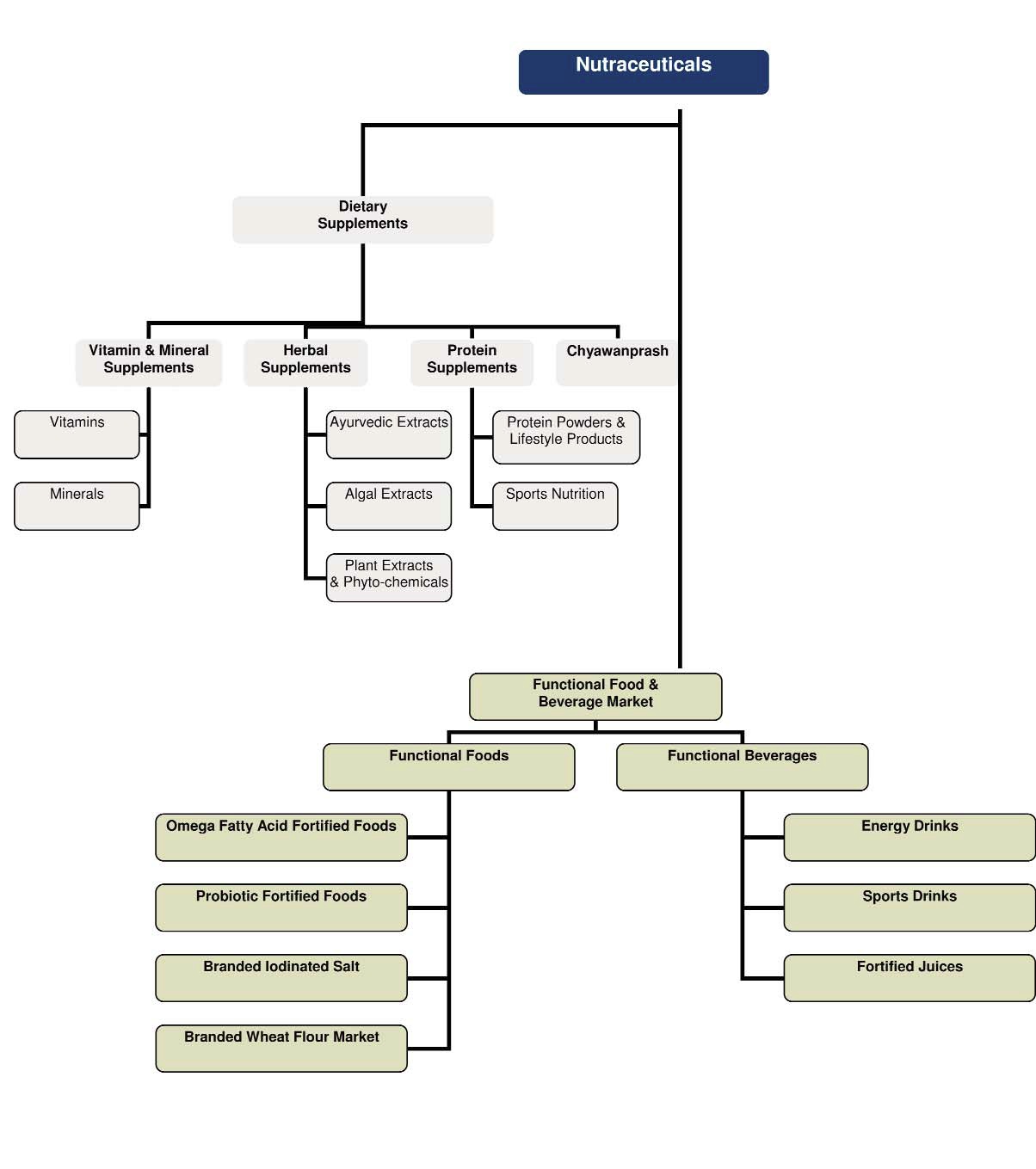

Chart

Source: Frost & Sullivan

A white paper titled “Emerging insights on nutraceuticals - players and policy-makers” jointly, prepared by Grant Thornton and FICCI states consumers of nutraceuticals are demographically diverse: a malnourished child in a developing country, a young mother and her infant, an aged man / woman with prostate issues / severe osteoporosis, an ageing baby boomer who is willing to experiment with her food/ vitamin basket.

Globally, due to buoyant consumers acceptability, the US and Japan are the most developed markets for nutraceuticals. However, India, China and Brazil are developing nations which show huge potential for the nutraceuticals market.

Yesterday & today of nutra business

The industry research report titled “Global Nutraceutical Industry: Investing in Healthy Living,” has found that the global nutraceuticals market has seen maximum growth in the last decade. While, nutraceuticals as an industry emerged in the early 1990s, 2002-2010 has been the key growth period for the industry. From 1999 to 2002, the nutraceuticals industry grew at an annual average growth rate (AAGR) of 7.3 per cent, while from 2002 to 2010, the AAGR doubled to 14.7 per cent. The industry is expected to maintain comparable growth till 2015 driven by growth from India, China and Brazil. The report was jointly prepared by Frost & Sullivan and FICCI.

“Currently, worldwide nutraceuticals are gaining prominence and becoming a part of the average consumer’s daily diet. The key reasons for this have been the increased incidence of lifestyle diseases the world over, increase in life expectancy and inadequate nutrition due to the current lifestyle choices people make today. In fact, in developing nations, mortality due to nutrition-related factors is nearly 40 per cent, underscoring the need for nutraceuticals products, to balance the nutritional intake of the individual,” the report said.

“While the Indian industry is currently nascent, it has great potential and is expected to grow at a growth rate of 16 per cent year-on-year for the next five years. This makes it one of the key markets for entry for nutraceutical products and ingredient manufacturers,” it added.

Trends: Worldwide

According to Grant Thornton’s white paper, the ongoing trends in the nutraceuticals businesses are

Multiple micronutrient intervention studies: The ongoing research in various corners of the world aims to establish a link between single and multiple micronutrient intervention studies and diseases of the human body to arrive at a holistic nutritional approach for combat. The evidence supporting the role of interventions in the prevention of various diseases however is still evolving.

New Dimensions: The usage of nutrients has increased from traditional forms (foods, supplements and beverages) to new markets such as cosmetics, pet care, marine life, and sports.

• Antioxidants for longevity, immunity and vitality

• Increased demand from the highest risk categories of baby boomers

• Non-prescription-based cosmetics with medicinal (including anti-ageing) properties

• Functional and medicated confectionery foods and snack bars

• Fatty Acids (CLA and Omega 3, 6 and 9) and proteins & clinical evidence of their health benefits

• Pet nutraceuticals & sports nutraceuticals

• Functional additives - vitamins, proteins, fibres

Trends in India

Even with the lowest per capita GDP in the BRIC regions, India is poised to overtake China as the most populous country (also with the largest number of undernourished children in the world), and represents an extremely favourable market for the growth of nutraceuticals.

At population levels like ours combined with income disparities, the need for nutrition arises in each strata of our society. While approximately 42 per cent of all Indian children under age 5 suffer from malnutrition, nearly 300 million people are part of an expanding middle class. The middle-class level, with increased disposable incomes has become aware of the importance of diet and nutrition for long- term good health. Rajiv Chopra, president, DSM India, said, “Healthy habits need to start young. Only an appropriate blend of micro / macro nutrients in our diet can help us break through the health deficit.”

Some key emerging trends in the Indian nutraceuticals space are

• Focus on wellness and preventive care.

• Increased awareness and health consciousness.

• Growth currently driven by the functional food and beverages segment.

• Health and wellness yet to reach the fat and oils segment.

• Increased accessibility through new distribution channels and greater visibility (example infant and sports nutrition).

• A large diabetic population (similar to Brazil and China).

• Vitamins used in several food fortifications.

• Mass market retailing is just getting off ground in India with FDI approvals and can represent a great way to market the nutraceuticals.

• One third of the population being vegetarian, protein supplements in the form of soya / rice / others can assume great significance.

• Flavoured, powdered milk fortified with vitamins and minerals is a recent trend. In other parts of the country, milk scarcity drives soya and skimmed milk demand.

Also, India and China have emerged as a key sourcing destination for natural ingredients. Each of the countries in the BRIC region is in different evolutionary stages of development and nutraceuticals are subject to differences in regulation, nutrition awareness, consumer demand, biological support and affordability. China and Brazil have an advanced regulatory framework for the approval of nutraceuticals and their advertising, although these differ somewhat in the specifics.

Top players

Our country can be viewed both as a developer and manufacturer of nutraceuticals ingredients and products, and as a strong emerging market for nutraceuticals. “Key stakeholders in the Indian nutraceuticals landscape need to focus on the following Critical Success Factors – providing access to food in the first place, ensuring the right quality and mix of food, weeding out adulteration, improving the general environment and ensuring the availability of clean drinking water for all,” Chopra added.

Key players in Indian nutraceuticals business include Zydus, Plethico (including subsidiary Natrol), Piramal Healthcare, Elder Pharma, Universal Medicare (Sanofi), Nandan, Tablets India Ltd, Hexagon Nutrition, Natural Remedies, Dabur, and Advanced Enzymes.

The international companies that are existent and growing in the Indian market are DSM nutritional products, Abbott nutrition, GSK, Amway, and Herbalife.

|

|

|

|

|

|

|

|

|

|